If you’ve ever decided to walk away from part of your business too – that you know is super valuable for your clients and generates positive cashflow for you – you’ll know how tough a decision that can be!

Taking REAL Control Of Your Finances (At Last!)

I am choosing to opt out of all the financial doom-mongering – the relentless narrative in the media about prices rises and inflation and the middle being squeezed – and instead, choose to focus on the positives. And on what I can do to take control and be in the strongest financial position possible, in my own life and business.

Opting Out of the Financial Doom-Mongering(+ Living Your Dreams!)

Is there actually light at the end of the tunnel?

Now we’re approaching what feels like the end of COVID (although by the time you drop in monkeypox and all sorts of other stuff that seems to be happening, I guess we never quite know!).

But it’s definitely time to start thinking about not just surviving and getting by, but actually looking at planning for the things that we really WANT to do and have in our life.

Are You On Top Of Your 2022 Money Goals? Here’s How To Make Them Happen!

If you’re someone who’s quite spontaneous – which let’s be honest, I think lots of us entrepreneurial and creative types are – setting ourselves rigid targets and making financial plans can feel slightly restrictive. But having something to at least aim for is going to show that you’re on track. Because otherwise, how do you know that your business is moving in the right direction and heading towards where you really want to be?

Are you STILL taking miniature toiletries home from your hotel stays?

There are some really good reasons why those little scented marvels end up in your luggage, but also a couple which may be un-consciously scuppering your wealth journey… so let me tell you how to work out which route you’re on.

YOU can set your kids up as millionaires for less than the price of 2 weeks in Mexico!

The thing about growing your wealth is that you need to have TIME for your money to grow. (Those flash in the pan get rich quick schemes are best avoided!) And of course, you can invest a pot of money for your own future dreams too… or have more than one pot, each with a different objective.

Ever wish you were size 8 with £1million in the bank?!

Health and wealth are so very similar (which is why I often compare them in my blogs and posts!).

George Clooney and a Jar Of Chocolate Spread…

George Clooney and a jar of chocolate spread…

Just me?!

Well – do keep reading. Because today, I want to talk about why this is actually relevant to YOUR life, YOUR dreams and YOUR big goals!

Where Your Focus Goes, Your Money Grows…Time To Get INTENTIONAL!

We’re talking today about giving each £ a purpose and using your money intentionally. So you can achieve the things you want in your life, like saving for the future or planning for some big dream!

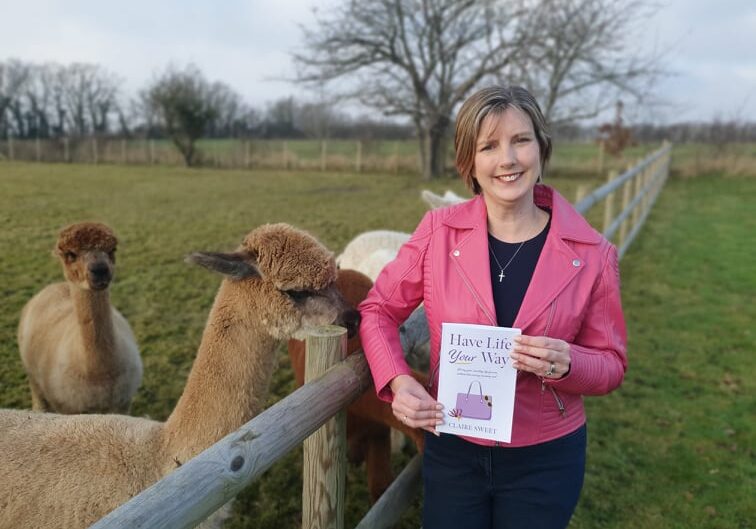

Why I Wrote The Book On Money

(+ Why You NEED To Read It!)

There are tons of finance books out there. Big ones; small ones and everything in between.

I personally know at least 3 other Financial Advisers who’ve got published works to their name.

So why did I write a book? What was the point?

What Money Stuff Have YOU Been Putting Off? {It’s time to get it DONE!}

How many things do we put off? Because we know they’re important…but they just never seem to feel urgent?

Take last month, for example. At the time of writing this, a couple of weeks ago it was tax return time (dreaded in the minds of so many!).

How many people do you know who decided to submit their tax return on the January 31st? Who left doing anything about it until the very last minute?

#3 Ways to Build Wealth in 2022!

What I’m talking about are your goals for this year. The things you REALLY want to achieve.

They might be business goals; they might be personal goals or most likely, a combination of both.

But as business owners and entrepreneurs, we all need to have a clear idea of where we’re heading. After all, you wouldn’t get on a bus that didn’t have the destination printed on the front of it.

Making more BUT spending more too? You need a PLAN!

When your business starts making money, most people (understandably) go through a phase of splashing the cash. A new phone; upgrading your laptop; investing in a better webcam or microphone for your videos; subscriptions for more tech or the latest software that pings up in your feed and promises to make your life easier.

If your family don’t ‘get’ what you do…READ THIS!

It’s Christmas…which means it’s time to face the family!

Most of us have family we don’t see that often (especially over the last couple of years).

Every year, you sit there trying to make polite conversation with these people you grew up with. You love them. You care about them.

But what if you feel like you have nothing in common anymore?!

Are you ending this year where you REALLY want to be?

Did you want a Waitrose Christmas this year?

Maybe you picked up their glossy festive brochure (that seems to appear in store earlier and earlier!). Or maybe you’d love all the pre-prepared trimmings or veggie centrepiece or fancy deserts from their adverts.

But somehow, you’re still ending up doing your Christmas food shopping at Tesco?

Wherever you shop, this is REALLY about whether you’re ending 2021 where you wanted to be.

If Sorting All Your Money Stuff Feels Totally Overwhelming…

The #1 reason people don’t tackle their financial stuff is a huge sense of overwhelm, when they look at the mountain of things they need to sort out.

Do This NOW…To Make 2022 The Year Your BIG Goals Happen!

NOW is the time to tidy up all your financial loose ends, so they don’t get away in the way of next year’s goals!

Do Your Prices End In £7 or £9? Why It’s NOT The Best Idea!

Have you ever wondered about all those prices that you see ending in 99p or £7?

And WHY we all do it?

Well – I don’t know anymore. I’ve had enough. And I’m taking a stand!

The BIG Questions To Ask Your Accountant!

Accountants have a wealth of knowledge and can be a hugely valuable part of your team, as the financial expert (or one of them ) within your business to help you actually make sense of your numbers.

But what if you don’t really understand what you’re meant to be asking them at all?

Do You Know Your Profit? The Numbers You Should REALLY Be Tracking!

If you spend any time on social media, you’ll see business owners talking about how much money they’re making. But what figure are they actually talking about? And are they talking about it in pounds or dollars? Because that can make a massive difference.