I’m all for making money manageable!

The #1 reason people don’t tackle their financial stuff is a huge sense of overwhelm, when they look at the mountain of things they need to sort out.

Like their pension; Will; savings account; insurances; investments…just generally taking control of their business and personal finances (and maybe setting up pensions and savings accounts for the kids, too).

Of course, as a grown up and as a business owner, they KNOW it’s up to them to sort it out! But there’s always something that just seems more important to get done.

Maybe this is all sounding familiar for you, too.

Maybe you’ve been meaning to get your pension set up for ages or that new ISA opened.

But when you think about all the things you want to get in place, you can’t decide which one is most important to do. Or even where to start.

The truth is it doesn’t really matter where you start. What matters is simply making progress! So today we’re talking about breaking your finances down into bite-size steps, so you can start to get everything organised.

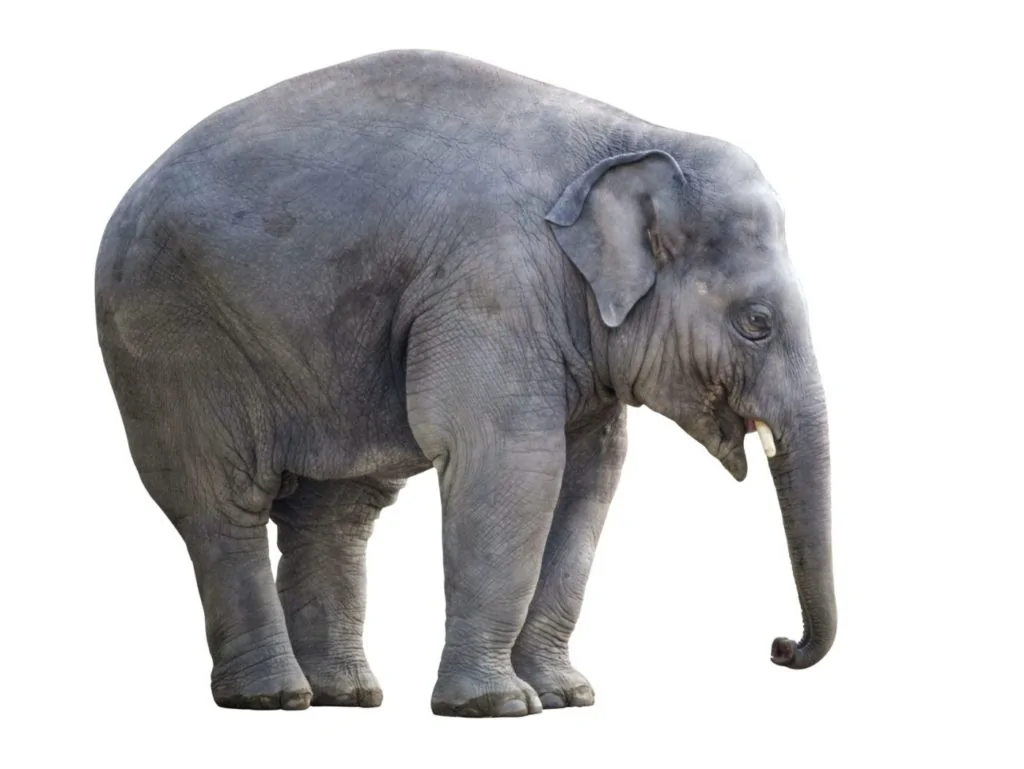

Remember that old saying: “How do you eat an elephant? One bite at a time”.

It’s the same with any big job and in my experience of working with hundreds of clients over the last 14 years, overhauling your finances does feel like that.

It feels like eating an elephant or conquering a mountain, a hugely daunting task – but you want to make sure you do it AND that you do it right.

So! Let’s break this all down, into steps that actually feel manageable for you to be able to go off and do today.

The first step is always to work out where you are now. Which means taking some time out from whatever you’re doing at work or at home and just sitting down and looking at it.

Pick one element of your finances to focus on first.

You might decide you’re going to look at your savings accounts first and creating your emergency fund.

It might be writing your Will or looking at your life cover and protection policies.

I know you probably want to sort it all! But the trick is just picking ONE thing first and making a start on that (otherwise the overwhelm kicks in – and you can move on to everything else later).

Let’s say you’ve decided that writing your Will is the ONE thing you really want to get covered first.

Your Will is incredibly important and makes a lot of sense to prioritise. After all, you’ve spent so much time and effort building your business, growing your wealth and buying things (assets!), that you at least want a bit of a say about who gets what after you’re gone.

Maybe you’ve been told that you need to think about inheritance tax and you want to make sure that everything is done and the loose ends are tied up. So that when your family are at that horrible point in life where you’ve passed away and they’re left behind, you don’t leave them a paperwork nightmare to deal with, while trying to manage all their grief.

So what to do next?

Firstly, decide who will write your Will for you. Are you going to find an online Will writer? Go to a solicitor? Speak to your financial advisor? Buy a kit and do it yourself?

Whichever you choose, there’ll be a step-by-step process to go through, where you need to work out who you want to be your executors to follow your wishes after you’re gone.

Then – who you want to have your stuff? Do you need to make decisions about that or have you already worked it out?

You also might want to think about who looks after your children if something happens to you, because it’s not just automatic that they get to live with grandma.

If something happens to both parents, your children could end up as wards of court, which means that they could end up in foster care while waiting for your family to apply for residence. It’s horrendous enough to lose both parents without then ending up living with strangers at a really emotional time.

Once you’ve decided who’s going to write your Will and what you want to happen when you’re gone, you need to GET ON AND DO IT! This is the missing step I see over and over again…actually taking action.

It’s all well and good to decide that this year you’re going to (re)write your Will, but you need to get up and actually do it.

So set yourself a target and put it up on your to do list – but better still, carve out the time in your diary to actually make it happen. You’ll feel so much better when you have and you can cross it off your list, and then you can move on to something else.

So bit by bit, work your way through each thing on your list and work out what needs to happen.

Now I know that for a lot of my clients, their finances are up in the air when they come to me!

They just want a simple and logical way to work out HOW to do all this stuff, without having to spend hours Googling it (and then not feeling sure the information is 100% right).

Which is exactly why I created my 6-week ROCK Solid™ programme!

So you know how to sort your Will out and powers of attorney and all those legal financial things that matter so much.

You know exactly how to create your comfort blanket (the ‘C’ in ROCK Solid™) – your financial safety net and how much money you need in emergency savings.

You know whether you need to set up some life insurance or private sick pay if you’re a business owner and exactly how to put them in place.

And SO much more besides!

Things like making sure that you’ve got a regular income coming in from your business, every single month. Organising your bank accounts and having a clear dream or goal to focus on – with the financial security net in place, that gives comfort and peace of mind to so many of my clients.

Because that’s the whole point.

I launched ROCK Solid™ back in the summer, because I wanted an entry-level way for people to get their financial foundations straight and to feel secure, even if they weren’t at the stage where they could work with me 1:1.

Once you’ve done it – once you have everything sorted out, one little step at a time – you KNOW that if anything were to happen to you, that your family is going to be ok.

I just think it’s huge. We go into business because we want a better life for us and our family, and after building this wonderful thing, you want to KNOW it’s rock solid. That it’s not just going to crumble away if you’re not there.

Here’s where you can get full details and to join ROCK Solid™ now.

To go back to where we started today – I’m all for making money manageable.

The whole programme has been created to help you tackle everything in simple, bite-sized steps, so you never feel overwhelmed or like you just want to run away or bury your head in sand and neglect all the financial stuff for even longer.

It’s TIME to eat that elephant…

Come join us inside Rock Solid™ today!

Until next time,

Claire