Who else wishes you’d invested in Zoom shares, before the Covid19 lockdown hit?!

And imagine if you’d got in when everyone thought Facebook was just a fad. You’d be drinking margaritas from your Caribbean beach house right now.

After all, David Choe chose to take shares instead of cash for painting the walls of Facebook’s first office in 2005. Now those shares are worth $200 million.

Investing is something that will make you a load of money – right?

Well…no. Not always.

Loads of companies fail. And even those that do become successful can take years to get there.

But with the right strategy, we can ALL build a sizeable pot of our own.

One thing I hear all the time is that investing is a major risk. Why would you want to do that?

The truth is it’s all about risk and reward.

If you take no risk at all and leave your money in a basic savings account, you’re likely to get paid interest at around 0.01% per year.

Which means that for every £1,000 you have sitting in savings, you’ll get £1 in interest.

That’s £1 PER YEAR!

This isn’t likely to be much of a problem for your short-term savings. Like cash tucked away for this year’s tax bill. Or your emergency fund – for when the boiler goes; your car needs new brakes or paying the vet’s bill when your dog gets sick.

The problem is that longer-term, if you leave your money in a basic savings account, its value will be eroded by inflation. So you end up having less and less buying power in the future.

Let’s talk inflation!

In a nutshell – inflation is a measure of how much things cost this year, compared to last year.

Usually it’s between 2-3% per year (it only looks lower in 2020, due to shops and businesses being closed during coronavirus).

In real terms – remember when you were a teenager and Mars Bars were 35p? Or your parents house, that they bought for £60k and is now worth £300k?

Money that you want for your medium to long term future – at least 5-10 years from now – needs to be invested. So it grows in a way that beats inflation and turns your hard-earned cash into something useful.

So how DO you do invest your money safely?

Rule #1. Diversify!

Basically, don’t put all your eggs in one basket. Yes, you could pick the next Microsoft – but equally, you could pick the next Betamax video.

Aim to invest in at least 65-100 different companies (more if possible). So that if one fails, you don’t lose all your money.

And ensure your shares are NOT just UK based.

The easiest way to do this is to use a collective investment.

These are funds that contain a wide range of shares, bonds, exposure to rental property etc – and effectively you buy shares in the fund.

The fund will either be actively managed, with a fund manager choosing what will be inside, or will be a passive index tracker.

Index trackers follow the movement of a specific index (like the FTSE100), by buying shares in a range of popular companies (largely controlled by computer).

And they’re available with different combinations of components – so you can take more or less risk with your money – depending on your personal preference.

Then, you need to choose a wrapper for your fund.

Although you can hold them in a simple investment account, this means you’ll be paying more tax than you need to, either now or in years to come.

Most people either use a pension or ISA wrapper for their investments.

A pension will give you tax relief on your contributions.

Every £100 you put in has £25 added free by HMRC. BUT you can’t have the money until you’re 55 (honestly, anything that says otherwise is a scam!). You’ll also be liable for tax on some of the money, when the time comes to take an income from it.

An ISA has no upfront tax relief – but any money you take from it is tax-free in the future.

So you can use an ISA to top-up your pension or earned income, without paying any more tax.

You can also take this money out before you are 55 – although like all investments, because the market is volatile over the short-term, it’s always advisable to leave the money for at least 5-10 years before you look to withdraw it.

And you know how the statutory wording goes – past performance is not a reliable indicator of future growth, and you may get out less than you put in.

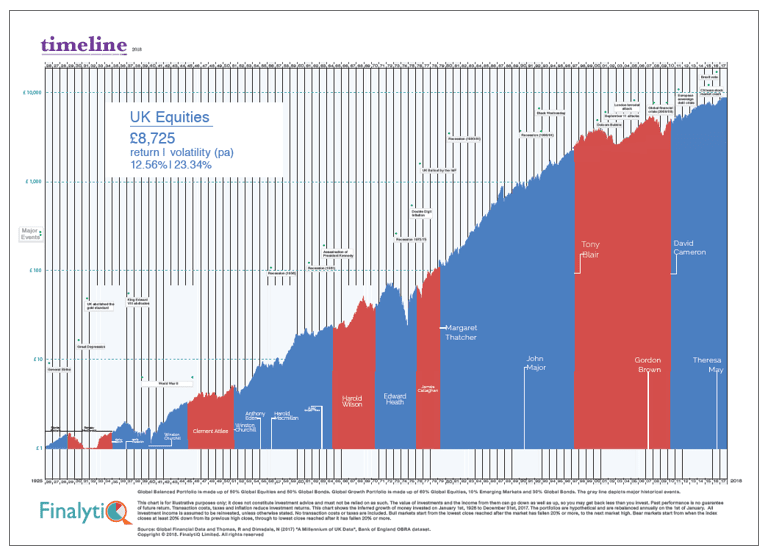

But if you look at the past from 1925 to 2018, there is a general upwards trend over the long term!

Rule #2. Start as early as you can!

The sooner you start, the longer your money has to grow.

Even if it’s just a small amount – £100 or so – that you pay regularly every month.

This also means you can take advantage of fluctuations in unit price – buying more when the price is low, and less when prices are higher. Which over the long term, is more successful than trying to time the market and invest when prices are low.

Like the old saying goes: It’s not about timing the market, it’s about time IN the market…

Just £100 a month invested in a fund growing at 7% a year – quite typical for an index tracker – is likely to get you around £123,000 in 30 years’ time.

And if you invested £240 a month into a pension for your child, until they were 18 – and then they continue paying in £180 a month – they could retire with a pot worth around a £1 MILLION.

It’s to do with compounding and re-investing of dividends. Which means you can build quite a sizeable sum, over time.

To open a pension or Stocks and Share ISA, you can go online and use a reputable self-managed platform.

Or you can get help from a qualified Financial Adviser – like me! – to make 100% sure you have the right product, at the right risk level, for your needs.

Whichever path you choose, remember this is money you need to tie up for at LEAST 5 years.

This is long-term growth. Not get rich quick.

So if you ARE going to start investing, it’s crucial to make sure you’re building your emergency fund as well, with cash to hand when you need it.

If you’d love some support, to work through all your options and make a plan of action – I’d love to help!

I’m a fully qualified Financial Adviser, with over 12 years’ industry experience AND I’ve been trusted with over £3.2million of my clients’ money to invest.

Just click here to book a free, confidential chat today!

Until next time,

Claire