With people living longer, being more active and having more options than ever before, retirement planning can be overwhelming, confusing and one of those things that

In the old days, many people stayed in the same job for 30 years, retired and then received a company pension – plus if they’d paid enough National Insurance Contributions a state pension too.

It’s not like that now. Someone staying with the same employer for their whole career is practically unheard of, unless they work for the NHS or civil service. People change companies for better pay and opportunities, and it’s not unheard of for people to change careers entirely.

And because people are retraining to do their dream job, and then working until they are older – retirement these days is for many people simply the time when they want to work less hard rather than stop work completely. With this in mind – there are 3 common mistakes that you should avoid when looking at planning your later life income.

1. Relying on your state pension

Over the last few years the State retirement Age (SRA) has been raised to 67, and is creeping upwards. Those of us born after 1970 are likely to be 68 before we can draw our State Retirement Pension (SRP) and although we know that at today’s rates it’s worth about £8546 per year, there is no guarantee that any future government will continue to increase the amount payable year on year, or will be able to afford to if age expectancy continues to rise.

To get a full SRP you will need 35 years of National Insurance contributions. You can also check your NI record on the gov.uk website to check that you will have the required years. If you are employed by your own Ltd company on a low salary (plus dividends) and don’t pay National Insurance Contributions then you may have gaps for those years, unless you choose to make up the contributions voluntarily or are receiving NI credits because you claim child benefit for a child under 12.

You can check what level of SRP you’re likely to get by getting a State Pension Forecast though the Gov.UK gateway. But, even if you do qualify for a full SRP – what sort of quality of life would you have on £712 a month? You’ll need a way to top up this income if you don’t want to have to work forever.

2. Putting all your retirement savings in a pension

Don’t get me wrong, pensions are an excellent way to save for retirement. And for most people they are a good term strategy, their savings safely tucked away until retirement, but they are not the only way to save for retirement.

The best bit about pensions is that you get tax-relief on the contributions, effectively FREE money from HMRC.

The tax relief means that as a basic rate tax payer (typically earning less than £50k per year) for every £100 you contribute, HMRC gives you another £25 and a total of £125 goes into your chosen fund.

Higher rate tax payers get more, usually by adjustment of their tax code, or claimed by self-assessment.

The downside is that you can’t take the money back out until you are 55 or older – don’t believe scams that try to tell you otherwise – and although you usually get 25% of the pot tax free – you pay tax on the rest of the money as you withdraw it, at whatever rate of tax you pay at the time.

So you can’t use this to supplement your income if you decide to work less hard before the age of 55.

Other things that can be used to supplement your income are ISAs, rental property or business income (from a business that you own / control, but have people running for you). So it may be that a combination approach is needed to ensure you have the right money in the right place at the right time and that you don’t pay more tax on your income than you should.

In

3. Not keeping track of your investments

If you’ve changed jobs more than once, you could have a myriad of pensions dotted about all over the place and it can be really hard to keep track of them all.

Even if you only have a single pension, the likelihood is that although you may open the annual statement to look at the pot value, it will then get consigned to a drawer, or however you store paperwork at home.

When was the last time you worked out how much your pot would be worth at retirement, and if that would be enough to live on? You need to factor in growth of the investments, plan charges and inflation to get an accurate figure.

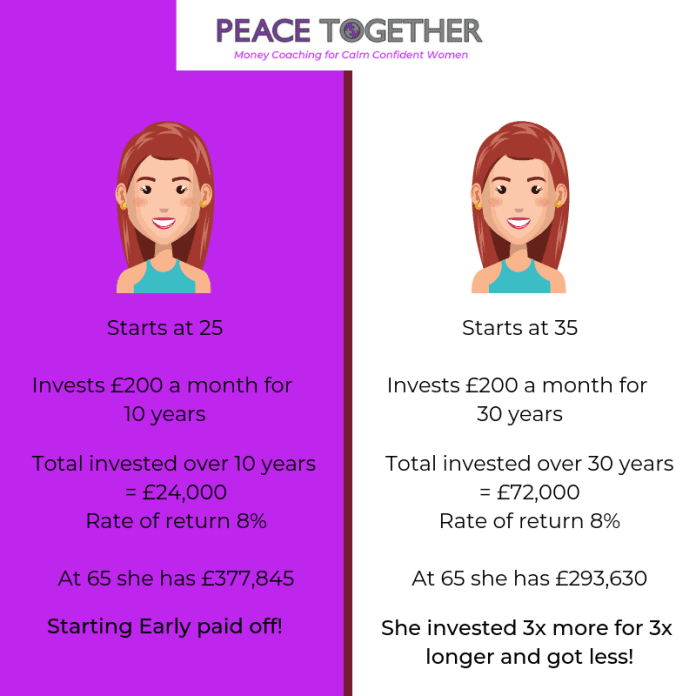

This can be tricky and although there are tools online that can help you do this, most people who regularly do financial forecasting do it with the help of their financial adviser or money coach. Because of the way that compound interest works, the earlier you start to save for retirement the better (in whichever savings vehicle/wrapper you choose) as your money has longer to grow, and as the dividends are re-invested your pot will get growth on these too. This means that for every 10 years you wait, you need to increase your contribution by 50% to reach the same endpoint.

Keep a regular eye on your retirement savings, and ask your financial adviser if consolidating your pensions might make them easier to monitor going forward.

If you have questions about any of this and need some more pointers, why not book a FREE discovery call so that we can chat about ways that we can help you get on top of your money?