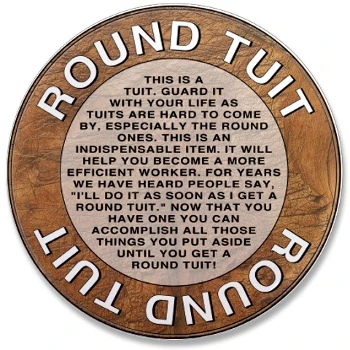

All joking aside, it was meant to serve as a reminder that there is often a pile of stuff that you will do – when you get around to it – that gets put off, again and again.

Retirement planning, tends to be one of those things that, like making a Will, gets pushed into this pile – everyone knows that you should do it…but it’s not really the most exciting thing in the world to do is it?

Doing nothing is one option – the new state pension, is available to those that have paid a minimum of 30 years National Insurance contributions – including those that have been given credits for caring for a child under the age of 18 – and is paid at a flat rate of £155.65 a week from state retirement age until death.

Can you live on £155.65 a week – or rather would you want to?

Most people appreciate that state pension (if it still available at the time we finally get to retire) is only going to cover the very basics and if they are to have any quality of life in retirement – which may last 30 years or more – they will need to make some provision for themselves.

This is where the wonders of compounding can work magic with your retirement savings. The earlier that you start to save for your retirement, the less you will need to contribute each month to get to the same end point – as your money will have longer to grow.

What does that look like?

Take for example – Helen a 30 year old, self-employed hairdresser earning £20,000 a year.

If she pays £100 a month into a private pension (which only costs her £80 due to HMRC top-up) when she retires, she will have built a pot of approximately £77,200 – in a medium growth/risk fund. This, with her state pension, would give her around £10,800 a year to live on until age 93 – which is average life expectancy for her date of birth.

But what if she waits?

If Helen waits until she is 40 to start to contribute – her £100 a month will only build her a pot of £48,200 – she would need to up her contribution to £157 a month – every month until retirement to have the same size pot at the end.

This is due to the effect of compounding – in the same way as with compound interest, you get growth on the previous years’ growth. If your fund of £12000 grows at 3% per year- next year you will have £12360, the next year £12730, then £13112 and so on. Obviously these are just theoretical examples and the performance of your investment will vary depending on many things – but you get the point.

Time is money. This is something to get on top of NOW.

What about ‘workplace pensions’ ?

The government has realised that there is a massive shortfall between the level of the State pension, and people’s expected standard of living and length of time they will be in retirement. To try to address this they have rolled out ‘auto-enrolment’ into workplace pensions, so that by the end of 2017, all eligible employees earning £10,000 a year or more will start to build a retirement pot, to which their employer will also contribute and they will have it topped up with tax-relief too (unless they opt out) – but what about self-employed people, and company directors?

Paying into a pension is a tax-efficient way to save for both companies and individuals – as contributions are made net of tax – at your highest rate.

So for a higher rate tax payer – every £60 they put in to a pension gets topped up by £40 from HMRC – it’s free money!!

What is even better, is that you have the choice of how your money is invested, and for how long – and by monitoring your investment annually, we can ensure that you are on track to meet your retirement goals – and that you retire on the amount that you choose – when you want to.

Please see our FCA regulated site if you would like to know more about retirement planning.