Most people go into business to make money. I know that there some seriously altruistic people out there, and that we all want to change the world in our own way – but you need to get paid, otherwise, you’re a charity… and to be fair, most CEOs of charities draw a salary.

When you started in business, you probably accepted that you might not make a profit your first year, and that it could be some time before you could start to draw a reasonable salary – but now that you’re generating decent revenues – where is all the money?

Why do you have to borrow from your savings to pay your salary bill?

Why do invoices sit unpaid on your desk for weeks?

Why do you constantly feel stressed about money in your business, causing a knock-on money headache at home?

And why do you see smiling photos of other 6 figure business owners on Instagram on their amazing luxury holiday and with the latest gifts and gadgets, when you’re facing a wet weekend in Whitby and another trip to Primark?

The ideal business model is one where you work the hours you choose, and draw the income that you wish – but this takes some element of planning and organisation, and if your business has grown rapidly, you may have struggled to keep your head above water, let alone put things in place that you probably need now your turnover has increased.

Having worked with successful business owners for more than 11 years, I’m going to share 2 top tips, which can help you get on track to free up the money to live the lifestyle you dream of – the reason you went into business in the first place.

Even implementing one of these will make a massive difference to your business, and ultimately your financial peace of mind – so let’s get started!

Tip 1 – Create a consistent salary

One of the biggest challenges for most people who go into business on their own is managing the irregular income. You could earn £800 today, nothing tomorrow and £50 the day after and then in 3 weeks’ time get £3000. How are you meant to budget for your bills with that?

The best way round this is to create a consistent salary – in effect like you were an employee so that you know exactly how much money you have coming in to your personal account and you can know that your bills are being paid on time.

For this to work, it is imperative that you have a separate account for your business. If you are a sole-trader or partnership this can be a ‘normal’ personal bank account – so either open a new one, or dig out the paperwork for an existing account that has been sitting there with £4 in for years but you’ve never got round to closing. If you have a Limited company, you’ll need to open a dedicated business account, as your company is a separate legal entity to you – even if you are the only director/shareholder.

Once you have money in your business account, set up a standing order for a fixed amount of salary per month. Ideally this amount should be equal to (or greater than) the amount that you need at home to pay your bills/expenses but they key thing is it is consistent, so you’d be better to pay in £400 a month EVERY month than do 500 one month and 300 the next.

This will mean that on good months you build up a surplus in your business account and that if you have a quiet month (or go on holiday) there is still money there to pay your salary. If after a few months there is too much surplus in your account and the surplus is increasing month on month, put your standing order up a bit and then leave it again for a few months before changing it again. The key is consistency.

If you are the sole wage earner, and what you can draw from your business is less than you need to pay your essential costs then you will need to make up the shortfall with savings, money from parents, get a lodger or a part-time job – Don’t let yourself get behind on your essential payments as it can kill your credit score and have disastrous consequences. You may even need to be brave and dramatically cut your expenditure figure by moving in with friends or family for a short period.

But, hey – there isn’t any money in my account to pay myself a salary – what do I do then?

You need to look at your cashflow – income vs expenses and work out why.

Tip 2 – Understand your Cashflow exercise

Take out a piece of paper, and write on in how much money is coming in this year. You can work from last year’s figures, or if your business is rapidly growing you may be better to look at the last 3 months bank statements instead.

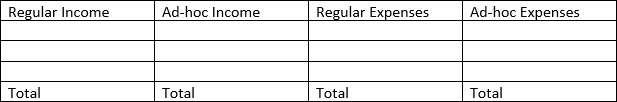

Divide your page into 4 columns – 1 & 2 are money in, and 3 & 4 money out.

Now look at how much money came in? How frequently if it is regular income, weekly/monthly/quarterly put it in the first column – you need to be looking at when the money actually hits your account. In the second column put variable or ad hoc income.

How much did you spend out?

In the same way, from your bank statements, put regular expenses – rent/phone/staff salaries in column 3 and the variable/one off stuff in column 4.

Now add up each column.

This will give you total earnings and total spending and the difference in simple terms is your profit. Woo hoo – you’ve just found the money to pay yourself a salary…. Or have you?

There are 2 likely outcomes to this exercise –

- You have a positive figure i.e. income of £10k – expenses of £8k = £2k surplus.

- You have a negative figure i.e. income of £6k – expenses of £8k = £2k deficit

What to do now?

If your business is making a profit – hooray! The surplus is what will pay your salary / drawings – but WAIT!

You can’t have all of that money!

Why not?

If your profit is more than your Personal Tax allowance – which for the current 2019-2020 tax year is £12,500 – you will need to pay at least 20% tax on it, plus National Insurance Contributions. So you need to put at least 20% into a savings account (or somewhere safe like the Premium Bonds) so that you have most or all of the money to pay your tax bills in January and July.

You should also hold back a percentage for investing in your business, as over time equipment will need replacing or upgrading, and you are likely to need to undergo training, coaching or some other way to drive your business on to the next level.

If your business is not making a profit – you need to ask yourself why?

- Did you have unexpected, or unusually high expenses this year?

- Is your business new – and you have a plan for growth?

- Are you attracting the amount of business you need?

The other thing you should ask yourself is – Are you spending too much on ‘stuff’ because you keep thinking “it’s ok, the business can pay for that” ?

When you go in to business it can be tempting to put everything you can through the company so as to reduce your profit, and the resultant amount of tax you pay.

However, you still need to pay for this stuff with money – and if you overspend, you will create a massive headache for you and your business.

There is nothing to stop you re-investing in your business, but it needs to be planned out and done at a manageable rate. Don’t move to a more swanky office, buy a brand new mobile phone or take on more staff without working out if the increased expense can be met by your business every month. Even on a quiet month.

I’d suggest doing the cashflow exercise at least once a year, and taking the opportunity to check that your account isn’t being clogged up with lots of little payments that soon add up. This might be £19.99 a month here and there for products you signed up for and now don’t use, or what you spend in PR/advertising/networking meetings to attract your clients – is it cost-effective? If you’d like to chat more about how we can help you organise your finances and build your dream, click here to book a FREE Zoom call, and we can tell you more about what we do!