Child benefit is paid to parents or full-time carers of one or more children under the age of 16 (or 20 if in full-time education). It was started back in 1946 as family allowance to encourage parents to keep their children in full time education rather than send them out to work, and to provide a basic income to help cover the increased costs of raising a family.

It has been tweaked over the years by successive governments into the Child benefit we know of today – it’s a non-means tested benefit, which means that you can claim it whatever your household income – and some more affluent parents choose to put this money away for their children rather than spend it.

Who can claim it?

Only one person can get Child Benefit for a child, and it’s usually the mother (or non-earning parent) that fills out the application form, tucked into the bundle of documents given to her after registering the birth of her baby. They will backdate it for up to 3 months, but after that any payments that would have been due are lost, so it’s best to get the form in as soon as possible.

You get £20.70 a week for the eldest child and the £13.70 for each sibling, and unlike child tax credit / universal credit, it is not restricted to only the first 2 children.

Child benefit is one of those things that most people with children in the UK claim, but with the most recent changes – many higher rate tax payers have chosen not to claim it – and today I’m going to tell you 2 reasons why this might not be the best option for them long term.

But higher rate tax payers have to pay it back, don’t they?

Yes, and no.

You don’t actually have to pay it back, but you may have to pay a tax charge if your (or your partner’s) individual income is over £50,000. It’s done through self-assessment if you’re a business owner, and means that you will pay a bit more tax than you expected.

The tax charge equates to 1% of the child benefit paid for every £100 of income between £50,000 and £60,000. So if you earn £56,000 a year, you’d pay back £600 of your child benefit and if either you or your partner earns more than £60,000, the tax means you’ll pay back the equivalent of your entire child benefit entitlement.

They count both salary and dividends, so paying yourself a small salary won’t avoid the tax charge, if you still take lots of dividends – but there are things that you can do to help avoid this situation.

Is there any way I can prevent them reclaiming my child benefit?

Yes! There are 4 main ways that you can reduce your relevant earnings so that you get to keep all of your child benefit.

- Pay into a personal pension

- Keep a record of all your gift aid payments

- Take a reduction in hours to reduce your salary / both work part-time**

- Take some of your ‘salary’ as an employer contribution towards your pension – sometimes called ‘salary sacrifice’ – you can do this if you own your own business too.

**It’s worth noting that the reduction of child benefit only happens when one partner earns more than £50k a year. If one parent earned £49k and the other £49k – you could still claim the child benefit, despite having a household income of £98k.

So why should I bother claiming?

You can choose not to get Child Benefit payments, but you should still fill in the claim form because:

1. It will help you get National Insurance credits which count towards your State Pension

If your child is under 12 and you’re not working or do not earn enough to pay National Insurance contributions, Child Benefit can help you qualify for National Insurance credits.

These credits count towards your State Pension. They protect it by making sure you do not have gaps in your National Insurance record – as you now need 35 years NI contributions to get a Full State Pension.

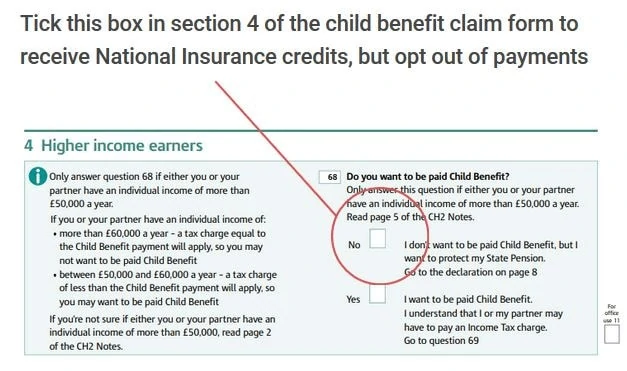

You just need to tick the right box on the form:

2. It will ensure your child is registered to get a National Insurance number when they’re 16 years old

A National Insurance Number is needed to allow your child to take a part-time (or full-time) job when they reach 16. Because of the way that employers can now get fined for not collecting the right documents when they hire a member of staff, this could cause a delay for your teen, should they want to start work.

It’s so much easier to have the NI number sent out automatically, rather than it be yet another piece of paperwork for you to fill out in an already hectic GCSE year.

For more useful money tips, head over to the FREE Facebook Group – and give me a shout if you have any questions!