With the rise of information available online, it can be tempting to cut out the middleman when searching for a new mortgage and some people may even think they can save money doing so, but there are other considerations to take into account.

The good news is that now all Financial Advisers and Mortgage Brokers need to be fully qualified and regulated, and they need to provide you with advice as to the mortgage most suitable for your needs – based on the information they get from you about your situation and future goals.

Some advisers specialise in particular types of client and may deal predominately with those that are self-employed, have credit problems or would like to buy an investment property. But regardless of this, all of them should understand the difference between different lender’s criteria, their affordability rules and the types of products they offer to borrowers.

Responsible Lending

As a client, it is good to know you are speaking to someone who not only knows what they are talking about but – most importantly – can choose products from the whole range of available options.

An important thing to understand is that when you receive whole of the market mortgage advice, your Financial Adviser has a duty of care to you. In fact, as an adviser they should be so confident in the level of advice they are providing that they back it up by presenting it in a signed and dated suitability report. If you subsequently discover their advice is not up to scratch you can complain and seek redress through proper channels, and this is a valuable layer of protection for you.

Your Bank or Building Society

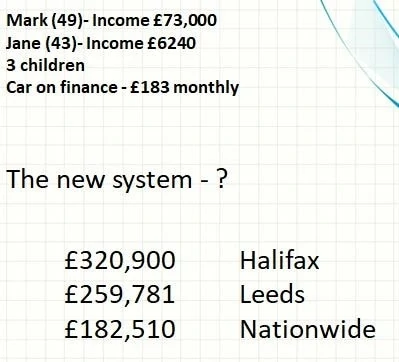

On the other hand, you could decide to go straight to your bank or building society and choose the cheapest fixed or tracker rate, that they offer – in the hope that you will be accepted, and that they will lend you the amount that you need. However, often after having waited some time for an appointment, this is often not the case and then you have to start the whole time-consuming process again, with another bank and wait to see their adviser, who will redo everything from scratch – and you will have an un-necessary search on your credit file, which can be seen by a subsequent lender, and may damage your chances of being accepted. This is where the advice of a fully qualified and experienced Financial Adviser comes into play – who can find you the correct product first time.

Whole of Market

Whole of market mortgage advice is just that, enabling the adviser to select for you from all the available products on the market, giving you the best possible chance of being accepted and stopping you from wasting time and money with a lender who looks good on the surface, but ultimately will not lend you the money that you need.

It is distinct from the advice of a bank or building society, which will offer products from its own range. It also differs from the advice of a multi-tied adviser, like those found in Estate Agents who will only offer mortgages from a limited range of providers. Whole of market Mortgage Advisers offer impartial advice, with the aim of helping you choose the right product for your circumstances.

A mortgage is a large financial commitment and may last for a long period of time, so it’s good to know you have had the options properly explained and received the information you need to make the best choice for your situation.

Check that your adviser is Whole of Market!