The great thing about the internet is that it brings information and education to us in a way that those of us that used to have to read books and go to a library could never predict.

But that doesn’t mean that everything you read online is true or accurate and it can be so hard to find someone with credibility and not just end up with someone’s opinion and personal success story – which may just not be viable for the average person.

Often these things that are bandied about as FACTS are not what they seem – and today I’m going to cover one of the BIGGEST and most commonly seen ones online.

“Don’t pay for an actively managed fund or a financial adviser, just set up your own pension / ISA and put the money in a cheap UK index tracker”

In this blog I’m not going to talk about the value of working with a financial adviser and how the money you pay them will be more than saved by their expertise in ensuring you have the right things in place, in the right name, ownership and tax wrapper… meaning more growth, less tax and a whole lot less stress than the DIY option. (A bit like using an accountant – a good one more than earns their worth)

I’m just going to look at the ‘stick it in a UK index tracker thing’.

Index trackers fall under the passive investment heading which means that they are computer controlled and cheap to run.

Which means for the investor, less money taken in charges and more left in the pot to grow – which is good, especially over the long term, as we know that growth compounds over time.

But the BIGGEST problem – is the lack of diversification. A UK index tracker ONLY contains UK companies. The S&P ONLY contains US companies.

So if you pick one of these your whole retirement pot is dependent on the state of the economy in your home country.

The decisions made by the powers that be, and other things that are outside of your control and taken in isolation from the rest of the world.

Which often may not be a good thing as often when one economy rises another is falling, or rises at a different rate due to the way we trade globally and how decisions in one country can affect those in another (like we’ve seen worldwide impact from Ukraine/ Russia).

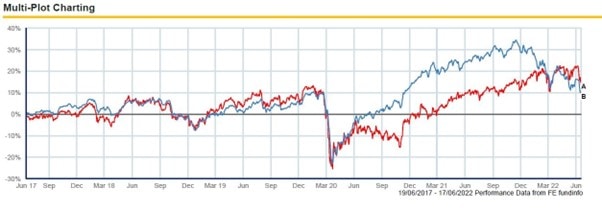

In times of worldwide uncertainty this can have a staggering impact on the growth of investments. The graph below shows an excerpt of a 5 year graph which I would typically use with a client when discussing this type of thing.

The red line is the FTSE100 over the last 5 years – 100% share based and as such fits with an ADVENTUROUS attitude to risk – as there are no bonds, property or other asset classes contained within them that can be used to provide any sort of stability or predictability

The blue line shows a typical actively managed dynamic fund – which as well as UK stocks and shares ALSO contains shares from elsewhere in the world (USA, Japan, EUROPE etc), plus some bonds and exposure to property (property funds, rental on out of town shopping centres, development projects).

What you can see is that both lines start in about the right place, and that as the red line goes up so does the blue line, but not quite as much – and when it goes down the blue line also drops – but not quite as much.

The mix of asset classes smooth out the volatility and help reduce the extreme spikes.

But where you notice a stark difference is the big C*vid dip – in about the middle of the graph March 2020.

Both lines drop sharply (we all saw that front pages of the tabloids…) but then you can see if you look at the blue line, but the November of that year (just 7 months later) the fund had recovered to the pre c*vid level and then has continued to grow from there. (run your finger horizontally across from just before the dip and you’ll see you’re at the same level later in the year).

By contrast the FTSE100 index didn’t recover until October 2021 – which was another 11 months later!!

So the gap between the 2 lines is the growth that people in a UK index-tracker MISSED out on over that 2 year period.

In fact over the last 10 years this particular well diversified actively managed fund has performed on average at 10.8% per year – where as the FTSE100 over the same period is 8.7%.

Which means EVEN allowing for an additional fund cost of about 0.75% the client is better off!

But it gets better than that.

Over the last 2 years we’ve been watching the performance of some of the PASSIVELY managed collective funds (still well diversified by country and asset class) and found that these are OUTPERFORMING their actively managed equivalents…so now they FULLY understand the difference, some clients are choosing to move sideways into those… (because more growth plus lower fees = super win)

So I’m talking about a passive fund performing at a rate more than DOUBLE that of the ‘cheap index tracker’ – with the same low management fees… wouldn’t it be great if an EXPERT could tell YOU that these things exist.. so that you could make better choices with your money…?

And once you have the knowledge you need – you could still go online and set up your own investment if you chose… or you could ask a financial adviser to help you (and get all the advice and support on the other things too )…or even go back to your own financial adviser and have a PROPER conversation about investment options… where you feel empowered to ask the RIGHT questions and make better choices.

How to use INVESTMENTS – including risk levels, management styles, wrappers, quirky investments, plus what to avoid investing in …and a whole lot more makes up a SIGNIFICANT part of my 1-2-1 Asset Mastery Programme – Magnetic Wealth™.

Over 12 months we create a wealth plan that takes you towards your financial objectives, filling in the gaps in your learning with some incredible training sessions run by me and a few select niche experts so that you can truly feel like you are managing your money and growing wealth in a way that works for you.

I’ll also help you put systems in place to stabilise your cashflow – even if you run a launch-based business, and ensure you have ROCK Solid™ foundations to build your wealth upon so you don’t end up raiding your dream fund to pay for car repairs or a vet bill. I’ll show you how to take home more money from what you’re currently making by paying less tax and utilising allowances we ALL get. So more income for you without increasing your sales.

I’ll help you get really COMFORTABLE with being a wealthy woman and all the opportunities that gives you.

AND I’ll also support you with monthly implementation and wealth tracking sessions so that you can see the progress you’re making towards your goals clearly, make the little tweaks you need to along the way AND carve out the time in your busy life to work ON your financial things – in a fun and effective way – whilst maintaining your privacy (absolutely no sharing your info with others…)

If you’d like to chat about whether my Asset Mastery programme could be your next step in growing your wealth and using your money to create something incredible – please send me a message and we can have a quick chat to see if you’re a good fit.