You know when you have one of those brainwaves – and you have no idea WHY you didn’t think of it before?!

It’s exactly how I feel about something I implemented into the lives of my 1:1 clients, earlier this year.

It seems so obvious now but felt incredibly radical at the time (and if you’re anything like my clients, I think you’ll love it too!).

Let me explain…

When you’re creating a wealth plan, or growing a business, or any other task really, you’ve got to break it down into smaller component parts. Otherwise it feels like this big overwhelming thing and you just don’t take action, because it seems too big to tackle.

BUT once you’ve broken your big goal down into all the little steps and things that need to happen, to move towards it, what do we end up with?

A list of things to do.

Now, I don’t know about you, but a to-do list doesn’t inspire me to take action. Quite the opposite. It feels massive, especially if it’s a big task and your list goes on for page after page. Even if you do get started, it can be really hard to see or feel that you’re actually making any progress.

So what’s the alternative? What can we do differently?

You know I like to be pioneering and I approach finance and business in a way that lots of other people simply don’t do.

And this is where I had the inspired brainwave… to create a big spider diagram.

Of course, things have moved on since the old spider diagrams of the 80s and 90s, back when everyone in the corporate world was doing them about anything and everything!

There’s a great online platform I now use called Miro, which I’d highly recommend checking out. Especially if you’re a very visual person, like me.

Or when I meet with 1:1 clients in person, we just use a big piece of paper and some coloured pens to get everything mapped out.

You start by putting your big goal in a circle in the middle – then draw out the ‘legs’, each component to get to the goal. And then you break those components down further into the little tasks to move forward.

The whole point is that you can break it down into different sections, and you can see it all clearly. It feels much more manageable and so much better than an uninspiring to-do list.

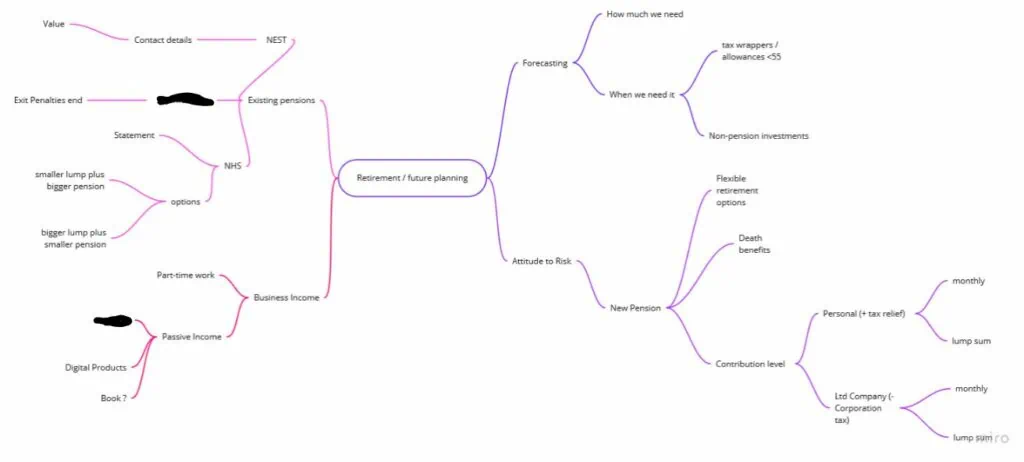

Here’s an example of one I did with a client recently:

Her goal was about retirement planning, because let’s face it, this is something I cover with most of my 1:1 clients. They want to know what the future is going to look like and how they can make sure they have enough money for everything they want to do and have, when the time comes, as well as having fun and living life right now.

So in the middle of our diagram, you can see we’ve written the word ‘retirement’. Then off to the right hand side, we’ve got a line and then another little circle that says ‘pensions’.

From there, there are more little legs – like ‘old pension’ and ‘current pension’. We’ve then broken those down further into that old company scheme that she had; the NEST pension that’s got hardly anything in it; and her state pension. How much will she actually get in terms of state pension when she retires?

By breaking everything down into these separate parts, not only does it break the task into manageable bits, but it helps you to see how the smaller bits join together to create the bigger picture and reach your overall goal.

There’s another leg too – ‘new pension’ – connecting off to two more little circles. One of them is about how much do I need? And one of them is how much can I afford to put in?

The how much can I afford to put in? circle then links through to the profit in the business, as well as surplus money in the home budget planner.

The how much do I need? circle connects to the vision board of what the perfect retirement looks like – and a calculator to work out how much money that lifestyle will take, depending on how much she’s got already and what age she wants to retire.

But the point is that once we’ve got all of these things out on a piece of paper, it makes it SO much easier to see how it all slots together. It also makes it much easier to take action on each little task, bit by bit, and to feel like you’re really achieving something as you tick each little task off.

Ultimately, it actually helps you move closer and closer to your big goal in the middle.

Now for something like retirement, you’re going to have more than one big leg coming off your central goal, because pensions are only part of retirement planning.

We’re going to look at ISAs; at other investments; at property. We’re going to look at what income you can have from your business in the future – whether you’re still working as a consultant; running an agency model or you’ve got a passive income product, a book or online course, which means you still generate revenue without sitting in the office all day long.

Your retirement is going to be made up of loads of different elements and your plan is going to be different from anybody else’s.

You need to be able to see and understand HOW these things all link together. When you properly connect the dots, you then know you’re making real progress towards your big goal, rather than wasting time and energy on things that aren’t relevant or simply won’t get you to where you want to be.

Because we’re busy! We’ve each only got a certain amount of time and if you’re taking time out to work on something to do with your finances – whether that’s retirement or paying off your mortgage or buying your dream home or anything else you want – you’ve GOT to make sure you’re using that time efficiently, and that the things that you need are all there. Otherwise what’s the point?

So for you…

What’s that big thing, that’s going in the centre of your chart? The goal? The thing you really want?

If it’s buying a new home, for example, you’ll need various legs coming off that central picture of your dream house. Like:

- How much deposit do you need?

- Where is it going to come from?

- Do you need to speak to your parents?

- Do you need to save it?

- If you need to save it, will that be saved from your surplus money each month?

- Have you got enough surplus money each month, to fund the amount of deposit you need?

- Have you done your budget planner?

And you start drawing out each of the little tasks, all of which are important to make sure your big goal actually happens.

Once you’ve got a deposit, the odds are you’re going to need a mortgage.

So your next leg might include things like:

- Have you got a financial advisor?

- Have you got the paperwork from your accountant?

- What do this year’s figures need to look like, to get the mortgage you need?

- How much is the mortgage payment going to be on that size house?

- Does that fit in with your budget? (Linking back up to your budget planner earlier on!)

- Do you need to be earning more money in your business? If so, how are you going to do that?

Ultimately, by looking at the big picture in this way and mapping it all out, we can really see what it needs to look like AND we can make sure that things are working the way they should, to create the outcome you want and make your big dreams your reality.

So!

If you want to sit down and do a full spider diagram with me, as part of your own personal wealth plan, there are two ways we can do this.

Option 1 is an Asset Mastery™ VIP Day – which will be you and me, with a stack of A3 paper and a load of coloured pens (if that’s your jam!). We’ll spend a full day together in person, doing a full expert deep-dive into all those financial things you’ve been meaning to get sorted. You’ll leave with an easy-to-follow plan, with all the steps to get from where you are now, to where you want to be, which you can then take away and implement with ease. Just click here now to find out more.

Option 2 is online, as part of my Asset Accelerator™ – where we do your spider diagram planning during a half-day session on Zoom, and you’ve got the online software to use. It’s a great option if you want ongoing expert support and accountability (over 9 months) to actually take ACTION on the plan you create. There are some brilliant bonuses too right now, including a Will Writing appointment (worth £350) – get all the details here.

If you want to have a chat about which option is right for you, you can also message me personally here on Facebook.

Here’s to getting everything out of your head and linking the dots with a brilliant spider diagram, that will really support you in your success!

Until next time,

Claire