6 bank accounts, are you kidding? No, and it’s revolutionised my attitude to money.

In part one, I discussed strategies that you could use to keep your spending under control and in this follow up, I’m going to explain more about how I do it, and how this has helped me.

In 2013 I worked with a business coach, who as a gift sent me a copy of Ann Wilson’s book The Wealth Chef. At the time I had just joined Blueprint and my business was in its infancy, cash-flow was poor and at times the bank account was empty. The sense of despair you can feel, when being self-employed if your account is empty, you have bills to pay and no knowledge of when you will next get paid is overwhelming.

So I read the book and followed the steps – and although it didn’t magically put money in my account, it enabled me to relax, take control and let me have a takeaway without guilt even though I felt like I was skint.

Using internet banking, all of my accounts are visible in one place on my PC or phone and I can move money easily between the pots as needed.

So how does it work?

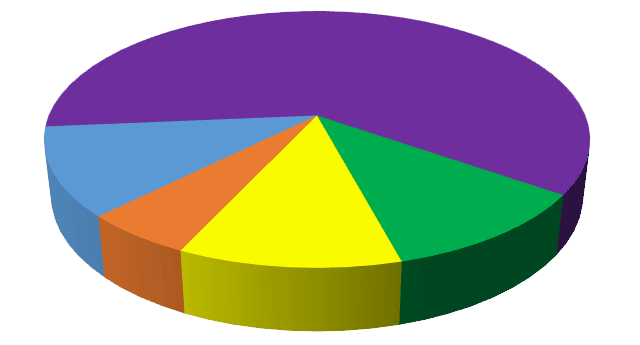

Every time you get paid, either by your employer or ‘wages’ you draw from your own business, you straight away move money into the necessary pots – each of which has a purpose. I have actually named my accounts as follows, to remind me what the money is for, and how much to put in.

1. Financial freedom 10%

This I run as a second current account, as it allows me to set up the direct debits for my investments which a savings account wouldn’t. I make contributions monthly, so that my pots have the maximum time to grow (compound interest) and so that I benefit from ‘pound cost averaging’ as the markets change.

I also contribute £25 a month into a ‘friendly society’ savings plan for my daughter – another tax-free savings vehicle, with the benefit of free life cover.

2. Fun Stuff 10%

This is where the magic happened for me – having a budget available for meals out, holiday spending money and theatre trips meant that even in the weeks where earnings were low, that I could have a takeaway without any guilt over the money spent.

Life is about experiences, and having money set aside for doing things that make you smile, will improve your quality of life no end. I actually have a sticker with the words ‘fun stuff’ on the debit card, which has started many conversations with restaurant staff over the last couple of years – although this is more to do with the fact that all my Lloyds Bank cards look the same!

Use this money on the things you enjoy doing, and try to spend most if not all of it each month.

3. Good causes 5%

Whether you believe in the law of attraction or not, in terms of mind-set – giving freely of your money lets your subconscious know that you are in a state of abundance and giving it away will result in you gaining more. It also instils a sense of gratitude, when you step back and realise how many people are not as fortunate as you.

And before you say that you’ll give money to charity when you earn more – if you can’t give £600 a year from £12,000 how will you ever be ready to give £3000 out of £60,000, or £50k out of your first million?

4. Save to Spend 10%

This is mainly for things that you pay for annually, but need to budget for each month – car insurance, holidays, home improvements, Christmas presents etc.

Having this money put aside is one of the most financially-savvy things that you can do, as it means that you don’t end up with money on a credit card to pay for bigger purchases, which means you avoid interest and bank charges. In the same way paying for your home/car insurance annually in one payment, is nearly always cheaper than paying in monthly instalments.

5. Self-improvement and Growth 10%

I also use this to pay for getting my hair and nails done, as I find this improves my professional image, self-confidence and allows me to be the best version of me that I can be.

I would also use this to pay for workshops or seminars to see motivating and inspirational speakers – if they are not paid for my business as ‘continuing professional development’ – so if you’ve always wanted to do a weekend with Tony Robbins or Jack Canfield or a yoga retreat – this is how you find the money.

This money is crucial to developing yourself as an individual, and if you choose to spend it on books, Audible or a gym membership / weight loss plan – that is your choice, but pick something that has value to you, your family and the word as a whole.

6. Current account

That leaves 55% left in the current account and that gets spent on housing, food, utilities, and other bills. This account also pays day-to-day spending such as petrol, parking and other living costs, clothes and other odd bits.

Now, before you say “ I can’t live on 55% of my take-home pay” – I would just point out that I don’t either – it’s 75% once I add back in the fun stuff and self-improvement money – the only money for everyday spending that is off limits is your Financial freedom, Savings and Charity money.

Separating your money helps you see where you are over/underspending and I bet that you are probably not spending nearly enough on you, and your future. All of us only have a set amount to spend each month, and you need to prioritise on what is important to you.

And you need to be flexible – what you deem as ‘fun stuff’ might be magazines, cigarettes and beer from a supermarket – or it might be a romantic meal out, a trip to LEGOLAND, theatre tickets or even breakfast in a café once a week. Use the money as you wish, on things that make you feel good – even if that means using it to get someone in to do your ironing.

You might find when you start out, that you need to dip into other pots to have money for everyday spending, but over time you will find that you fritter less cash and actually realise that you should be spending money on yourself as well as your bills and living expenses – it’s liberating!

A word of caution…

If you have un-secured consumer debt – there are slightly different percentages to put in each pot, allowing you to bust your debt, whilst still building a prosperous financial future. There is no point having a massive savings pot in today’s economic climate where you earn little if no interest, if you have thousands on a credit card and are paying out lots of interest on your debt.

Please get in touch to chat about how I paid off all my credit cards in less than 2 years, whilst still having money to have a meal out every so often.