Following on from Lesson 1 – If you don’t have it, you can’t spend it…

Lesson 2 – Free money is brilliant!

I explained the concept of bank interest to my 7-year-old this week.

“If you let the man at the bank look after your money, at the end of the year he will give you some free money. For every £10 we let him look after he will give you a free 30p – and you don’t have to give it back.”

Children’s savings accounts rates have fared a little better than the adult equivalent, with most banks offering something 2-3% on children’s accounts – not amazing, but better than the 0.1- 0.25% most adults get. Putting some money away each month is the single most important habit in keeping out of debt and eventually reaching financial freedom, and by starting early it becomes a habit just like brushing their teeth.

I tend to save half of the money they receive like birthday / Christmas money, and then let them spend the other half – my daughter (now 15) has several hundred pounds in the bank now, rather than it all having been spent on toys and other plastic junk, which would have been thrown away long before now – and she’s never missed it.

I would also suggest that teenagers should be encouraged to save a proportion of their earnings from a Saturday job as well – if they’ve never had the money, to save a percentage at pay-day (like we do with tax) will let them save for a holiday, first car or even the deposit for a first home if they save for long enough.

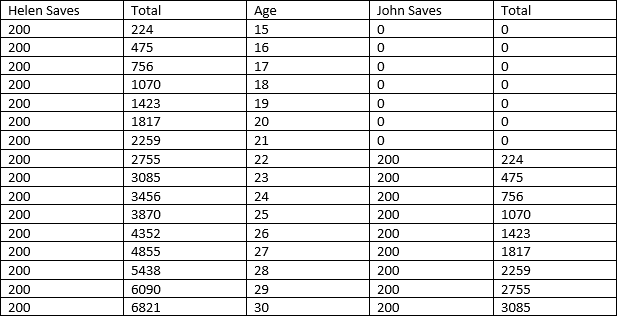

Compound interest means that they earlier that they start to save the better, and this can have a massive impact on the amount that they accrue over time. Even starting from an empty account and a relatively small amount paid in of £200 a year (£16.66 a month) it can build to a decent amount over time – and to be fair, it tends to grow at a faster rate, as once they see the balance growing they pay more in to the account and this boosts the pot further!

Compare the long-term impact of putting a little away from first part-time job, rather than waiting to leave University and get a permanent job.

There is no tax deducted on interest at the bank now, which means that a savings account often beats a cash junior ISA – and the post office investment account, once the gold standard for children’s savings, is very un-competitive in today’s market.

Once they get to 16 we can set up an-share based ISA account, including the new ‘Lifetime ISA’ which pays bonuses on money paid in (more free money) as well as benefit from the growth of the fund, which typically beats the savings rates offered by the banks over the longer term 5-10 years.

This links nicely to setting up a pension further down the line (more free money) and by them being used to not spending every penny that they earn, it encourages them to build an emergency fund that they can use if their car breaks down or they need to buy a suit for a funeral – rather than putting it on a credit card or taking out a payday loan – which is the single most damaging type of credit available, and yet surprisingly easy to obtain.

See also:

Lesson 1 – If you don’t have it, you can’t spend it

Lesson 3 – You will always have more than some people do, and less than others

Later in the year, we’ll be running our money workshops for teens – please let us know if you’d like to be added to the waiting list.