If you are going to manage your money well you need to understand what you have coming in and going out, and take 10 minutes every now and then to check that the figures balance and you are not spending more than you earn.

At some point, most people start to think about putting money away for the future in some form – the deposit for a home, a dream holiday or your retirement and what you choose to do next can have a massive effect on the end result.

This is where the difference between saving and investing really makes a difference.

Saving is just parking your money somewhere safe.

Piggy bank, current account, savings account – they all have the same end result. Your money is safe, what you put in you can take out whenever you want (usually without penalty) and as such there is no risk of loss – unless someone physically steals your money box, or raids it to pay the window cleaner. In the good old days, bank and building society accounts paid a decent rate of interest – often 5-8% – and you could watch your money grow with the benefit of compound interest.

Those days are long gone and interest rates are at an historic low, great news for borrowers, but meaning that for savers this period of high return, no risk is a memory from the past.

But why does it matter as long as my money is safe?

Inflation. Put simply, prices go up year on year and your £100 will buy you less next year than it will this year – and in 20 years’ time, your £100 may buy you very little if anything at all. Look at the price of everyday spending, and remember when a Mars Bar was 20p and petrol was 60p a litre.

This means that for short-term usage, when you will need the money in less than 5 years saving your money is fine. Your emergency fund of 3-6 months bills money should be in a savings account or other easy access place so that if your washing machine breaks or your car needs repairs you have money to hand to pay for it without resorting to a credit card.

But what else could I do – I don’t want to work forever?

If you do not need the money for more than 5 years, it is more usual to invest the money so that the growth beats inflation and when you come to retire, or use the money it is held its value and you have enough for your needs.

Investments carry some element of risk. Most people have heard of someone who bought shares in something that did really well – like in the privatisation of the utility companies in the 1980s/90s – but this is countered by the fact that some companies go bust, and if they do your shares become worthless.

Modern investing usually involves some sort of collective investment. This will be a combination of different shares, bonds and the like so that you are not reliant on the performance of a single company or sector for your growth – and to some extent the diversification protects you from losing all your money if a particular company or industry fails.

They usually have some sort of stocks and shares component which is designed to give growth over the medium to long term and in most cases will then balance this out with some lower risk products like bonds / gilts, property or cash equivalents.

There is a massive range of products available, some more risky than others, and although there are platforms online that will let you select your own products, a Financial Adviser can help you to choose something that matches your risk appetite and allows you to benefit from growth, without feeling uncomfortable about the future of your life savings.

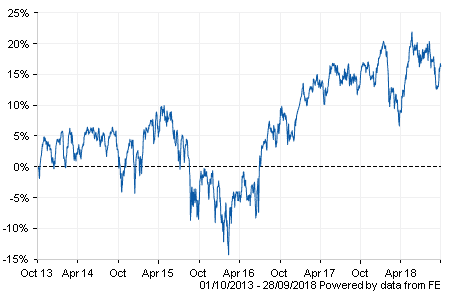

Investments over a ten year period tend to follow an uphill trend, but this is by no means a straight line (and past performance doesn’t guarantee future performance) and if you have time to ride out the dips in the market your investment will out-perform any cash-based savings account.

So if you’re tucking away money for your future, make sure it’s doing the best it can be. Dig out the statements and/or projection letters and if you’re not sure where your money is invested, how well it is growing or the charges you’re paying please get some help from a qualified professional.

As an example of the value of advice, research* shows that the average UK income in retirement is £19,000 per annum. However, the average for those who set goals working with a financial adviser is £26,000. Put another way, by not working with a financial adviser, a client can potentially lose out on an extra 36.8% or as much as £157,000 over the course of a 21 year retirement.

*OMW / YouGov survey July 2014